Navigating The Trading Landscape: A Comprehensive Guide To NSE Holidays In 2025

Navigating the Trading Landscape: A Comprehensive Guide to NSE Holidays in 2025

Related Articles: Navigating the Trading Landscape: A Comprehensive Guide to NSE Holidays in 2025

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Trading Landscape: A Comprehensive Guide to NSE Holidays in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Trading Landscape: A Comprehensive Guide to NSE Holidays in 2025

The National Stock Exchange of India (NSE) plays a pivotal role in the Indian financial market, facilitating the trading of equities, derivatives, and other financial instruments. Understanding the NSE’s holiday calendar is crucial for investors and traders alike, as it directly impacts market activity and trading opportunities. This comprehensive guide provides a detailed overview of NSE trading holidays in 2025, exploring their significance, potential implications, and practical considerations.

Understanding the Significance of NSE Holidays

NSE holidays are designated days when the stock exchange remains closed, halting all trading activities. These closures are typically mandated by the government or arise from religious and cultural observances. The rationale behind these holidays is multifaceted:

- Observing Cultural and Religious Events: NSE holidays often coincide with significant religious festivals and cultural celebrations, allowing individuals to participate in these events without disruption to their work schedules. This fosters a sense of community and cultural respect within the market.

- Facilitating Market Stability: Periods of heightened market volatility or unexpected events can necessitate temporary closures to ensure the stability and integrity of the financial system. NSE holidays, in such instances, provide a buffer for market participants to assess the situation and make informed decisions.

- Enabling Operational Efficiency: NSE holidays allow for essential maintenance and system upgrades, ensuring smooth and efficient operations. These periodic closures minimize disruptions to trading activities and enhance the overall reliability of the exchange platform.

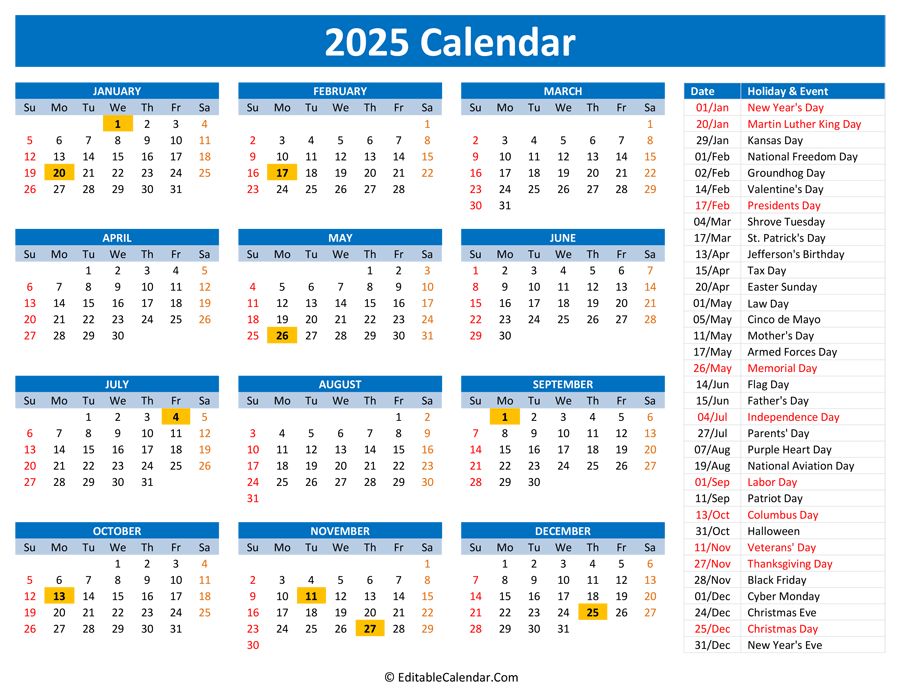

Navigating the 2025 Holiday Calendar: A Detailed Breakdown

The 2025 NSE holiday calendar is subject to confirmation and potential adjustments. However, based on historical patterns and anticipated events, we can anticipate a comprehensive list of holidays, encompassing both national and regional observances:

National Holidays:

- Republic Day: January 26th

- Holi: March 21st

- Good Friday: April 18th

- Mahavir Jayanti: April 25th

- Eid al-Fitr: May 3rd (Tentative, subject to lunar calendar)

- Buddha Purnima: May 12th

- Independence Day: August 15th

- Gandhi Jayanti: October 2nd

- Dussehra: October 17th

- Diwali: October 27th (Tentative, subject to lunar calendar)

- Christmas Day: December 25th

Regional Holidays:

- Gudi Padwa (Maharashtra): March 29th

- Ugadi (Andhra Pradesh, Telangana, Karnataka): March 29th

- Baisakhi (Punjab, Haryana, Himachal Pradesh): April 13th

- Bihu (Assam): April 14th

- Onam (Kerala): August 30th

- Dussehra (West Bengal): October 17th

- Durga Puja (West Bengal): October 17th-21st

- Raksha Bandhan (Punjab, Haryana, Himachal Pradesh): August 3rd

Other Potential Closures:

- Bank Holidays: While not directly mandated by the NSE, bank holidays often lead to market closures due to limited access to financial services.

- Special Events: Unforeseen events, such as natural disasters or political instability, may necessitate temporary market closures.

The Implications of NSE Holidays for Investors and Traders

NSE holidays have direct implications for market participants, impacting their trading strategies, investment decisions, and overall market activity. Understanding these implications is crucial for navigating the trading landscape effectively:

- Trading Halts: The closure of the NSE during holidays prohibits all trading activities, including buying, selling, and short-selling of securities. This can impact investors’ ability to execute trades and capitalize on market opportunities.

- Volatility and Liquidity: The absence of trading activity during holidays can create periods of market volatility and reduced liquidity. This can affect price movements and make it challenging for investors to enter or exit positions.

- Impact on Investment Strategies: Investors and traders need to adjust their strategies to account for NSE holidays. This may involve postponing trades, adjusting risk profiles, or exploring alternative investment avenues.

- Communication and Information Gaps: The closure of the NSE can disrupt communication channels and information flow. Market participants may face challenges in accessing real-time updates and making informed decisions.

FAQs: Addressing Common Concerns about NSE Holidays

1. What Happens to Orders Placed on NSE Holidays?

Orders placed on NSE holidays remain pending and are executed upon the market’s reopening. However, it’s important to note that market conditions may have changed during the closure, potentially affecting order execution.

2. Are There Any Exceptions to NSE Holiday Closures?

While NSE holidays are generally mandatory for all market participants, certain exceptions may apply. For instance, specific segments of the market, such as the derivatives market, may operate on a limited basis during certain holidays.

3. How Can I Stay Updated on NSE Holidays?

The NSE website and official announcements provide the most accurate and up-to-date information regarding holiday closures. It’s essential to consult these resources regularly to ensure you’re aware of any changes or updates.

4. What Should I Do If I Have an Urgent Trade to Execute During a Holiday?

In case of an urgent trade, it’s best to contact your broker or financial advisor for guidance. They can provide insights into alternative trading options or help you navigate the situation.

Tips for Effective Trading During NSE Holidays

- Plan Ahead: Review the NSE holiday calendar well in advance and factor it into your trading plans. This allows you to adjust your strategies and avoid potential disruptions.

- Stay Informed: Monitor official NSE announcements and news sources for any updates or changes to the holiday calendar.

- Communicate with Your Broker: Maintain open communication with your broker to discuss potential trading scenarios during holidays.

- Consider Alternative Strategies: Explore alternative investment options, such as off-market transactions or investments in non-stock instruments, during NSE closures.

- Manage Risk: Pay close attention to market volatility and liquidity during holidays and adjust your risk profile accordingly.

Conclusion: Embracing the Importance of NSE Holidays

NSE holidays, while impacting trading activity, play a vital role in the overall stability and efficiency of the Indian financial market. By observing cultural and religious events, facilitating market stability, and enabling operational efficiency, these closures contribute to a well-functioning and equitable trading ecosystem. Understanding the NSE holiday calendar and its implications is crucial for investors and traders to navigate the market effectively and make informed decisions, ensuring a smooth and successful trading experience.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Trading Landscape: A Comprehensive Guide to NSE Holidays in 2025. We appreciate your attention to our article. See you in our next article!

You may also like

Recent Posts

- National Holidays In Poland: 2025

- Navigating The March 2025 School Holidays In South Africa: A Comprehensive Guide

- Exploring The World In 2025: A Glimpse Into The Future Of Travel

- The Significance And Celebration Of New Year’s Day

- Navigating The Year: A Guide To National Holidays In 2025

- A Comprehensive Guide To March 2025 Holidays In Telangana

- An Exploration Of The African Safari Experience: November 2025

- Navigating March 2025 Holidays In Canada: A Comprehensive Guide

Leave a Reply